Pre-Launch Sale Ends: Sept 15, 2025

How to Make Sense of the Economy – When Nothing Adds Up.

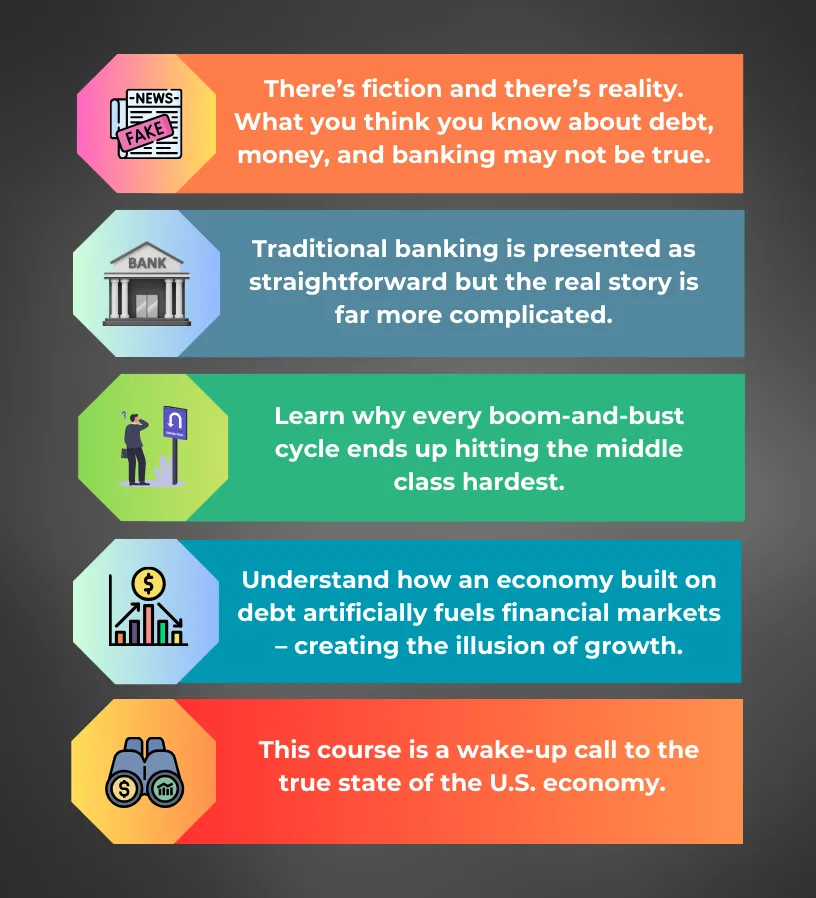

Trapped By Design

is an eye-opening course that pulls back the curtain on how the financial system really works focusing on the U.S. banking system. It’s the kind of education that should be taught in schools — but isn’t. With U.S. debt now over $37 trillion and skyrocketing, understanding how it's affecting you personally is more important than ever.”

PRE-LAUNCH SALE!

Join before Sept 15, 2025 to get 70% off. Enrol now & GET INSTANT ACCESS for only $147. (Regular Price: $497 )

"By implementing Anthony's dream school strategies I was able to get into The Grey School of Wizardry"

- Darryl

"By implementing Anthony's dream school strategies I was able to get into The Grey School of Wizardry"

- Darryl

Not Your Traditional Course

Hello My Name Is Luis

My Wake-up Call

I’ve spent 28 years working as a financial advisor.

And for the most part, I believed the system worked — that if you planned well and made smart decisions, you’d be rewarded.

But two major events shattered that belief: the 2008 financial crisis and the COVID shutdown in 2020.

Both times, in an attempt to stabilize the economy, trillions of newly created dollars were pumped into the system — sold to the public as “emergency measures” meant to keep everything from collapsing.

Fast forward to today… and those “emergency measures” still haven’t stopped.

What was supposed to be temporary has become standard practice — with trillions more being printed and borrowed every year.

Yet very few people are asking the deeper questions...

“Who really pays for all this money printing?”

"What are the long-term effects of creating money this way?"

“How can the stock market keep hitting record highs when the economy is so fragile?”

“What happens to my savings, my retirement, or my kids’ future if this keeps going?”

"Who truly benefits? "

It was questions like this is what pushed me to do my own research.

That’s why I created Trapped By Design — to give people the wake-up call I wish I had sooner.

Inside You’ll Learn:

🎯 Get a clear understanding of the key historical turning points that shaped the U.S. Banking system and the lessons they hold for the future.

🎯 Learn the mechanics behind debt and money creation explained clearly, with complex terms broken down so it actually makes sense. The truth may shock you.

🎯 How the Federal Reserve controls the U.S. money supply – and why its decisions ripple through interest rates, inflation, and global markets.”

🎯The hidden price of "easy money"’ – shrinking savings, weaker dollars, and long-term plans put at risk.

🎯 See through the illusion. Spot the gaps (the contradictions) between what you’re told – and what’s really happening in the economy.

Who SHOULD Take The Course?

✅ Want to learn the truth behind debt and money creation beyond the surface explanations you've been taught.

✅ Feels frustrated by rising costs, inflation, or debt and wants to know the forces driving them.

✅ Values learning from a historical perspective to better prepare for what may lay ahead in the economy.

✅ Seek to protect savings and purchasing power that's quietly being eroded to no fault of your own.

✅ You want the confidence to question the narrative and make financial decisions based on facts, not opinions.

Frequently Asked Questions

Do I need investment experience?

Not at all. The course is designed to explain complex topics in plain language, using examples and visuals to make them easier to understand.

Is this course only for people in the United States?

No. While the course focuses on the U.S. Federal Reserve and banking system, its influence extends worldwide. Because the U.S. dollar is the world’s reserve currency, the Fed’s policies ripple through global markets, affect international trade, and influence the value of other currencies.

Even if you live outside the U.S., understanding how the Fed operates will help you see why your savings, purchasing power, and economy are affected by decisions made in Washington.

Does the course provide financial advice?

No. Trapped By Design does not provide investment or financial advice. Instead, it delivers financial education — helping you understand how the monetary and banking system really works.

The goal isn’t to tell you what to buy, sell, or invest in. It’s to give you the clarity and knowledge to recognize how the system affects you, so you can make better-informed decisions for yourself and your family.

How is the course delivered?

The course is delivered entirely online, so you can access it from anywhere, at any time. Once you enroll, you’ll have instant access to the lessons and materials.

It’s designed for flexibility — you can learn at your own pace, revisit modules as often as you like, and fit the learning into your schedule. New modules will be added weekly until the course is complete, and you’ll have ongoing access to all updates.

© 2026

By visiting this page, you agree to terms and conditions, privacy policy & earnings disclaimer.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

DISCLAIMER: The sales figures stated on this landing page and discussed in the Trapped By Design are our personal sales figures and in some cases the sales figures of previous or existing clients. Please understand these results are not typical. We’re not implying you’ll duplicate them (or do anything for that matter). The average person who buys “how to” information gets little to no results. We’re using these references for example purposes only. Your results will vary and depend on many factors including but not limited to your background, experience, and work ethic. All business entails risk as well as massive and consistent effort and action. If you’re not willing to accept that, please DO NOT PURCHASE The Trapped By Design Program.